Advertising notice includes any notice that. The ACE Market is seen as the ideal market for start-ups and new companies which are run by entrepreneurs who are looking to push for more capital by listing their companies public.

Ace Market Enters A New Regulatory Regime The Edge Markets

Listing requirements in the ACE Market.

. Pursuant to rule 312H of the ACE Market Listing Requirements Listing Requirements issued by Bursa Securities an applicant must not issue or publish any advertising notice unless the requirements as may be prescribed by Bursa Securities are complied with. Promoter and chief executive of an ACE Market applicant are responsible for disclosures made in a pre-admission consultation pack listing application and prospectus together with the applicant its directors and. Transitional Arrangements in relation to the Application of the ACE Market Listing Requirements.

ACE Market Listing Requirements AMLR. 6 Unless otherwise specified a GN3 Company which intends to appeal against a de-listing under this Rule 804 must submit its appeal to the Exchange within 5 market days from the date of notification of de-listing by the Exchange. As 1 January 2022 Chapter 3.

ACE MARKET LISTING REQUIREMENTS S. As 1 January 2022 Chapter 2. ACE MARKET LISTING REQUIREMENTS S.

TABLE OF CONTENTS Page 1 ACE MARKET CHAPTER 1 DEFINITIONS AND INTERPRETATION PART A DEFINITIONS 101 Definitions PART B INTERPRETATION 102 Interpretation 103 Incidental powers etc of the Exchange 104 Gender 105 Singular and plural 106 Headings. Minimum issue price 50 sen 4. Key Changes of the Listing Requirements for ACE Market.

The Exchange has been the approving authority for ACE Market IPOs and all post-listing corporate proposals by ACE Market listed corporations except for debt securities since 2009. Consolidated Listing Requirements Updated to incorporate amendments issued up to 31 Dec 2015 MESDAQ Market. This is where Bursa Malaysia will rely on the Sponsor and then review the proposal of the company.

The ACE Market was derived together with the unification of the Main and Second Board into the Main Market of Bursa Malaysia in 2009. Rule 1008 must be read together with Rule 1009 of the Listing Requirements which is in relation to a Recurrent Related Party Transaction. Amendments to Bursa Malaysia Securities Berhad ACE Market Listing Requirements and Fees and Charges for the ACE Market Consequential to the Repeal of the Goods and Services Tax Pursuant to the Goods and Services Tax Repeal Act 2018.

As 1 January 2022. Independent market research report is optional for ACE Market listing application. This is where the company.

New Framework For Listings And Equity Fund-Raisings for Main Market. These documents contain the Main Market Listing Requirements which have been updated as at the date above and are posted on this website for the publics reference only. 17 May 2019 On 8 May 2019 Bursa Malaysia the Exchange released details of the amendments that will be made to the Main Market Listing Requirements and the ACE Market Listing Requirements collectively LR with effect from 3 June 2019.

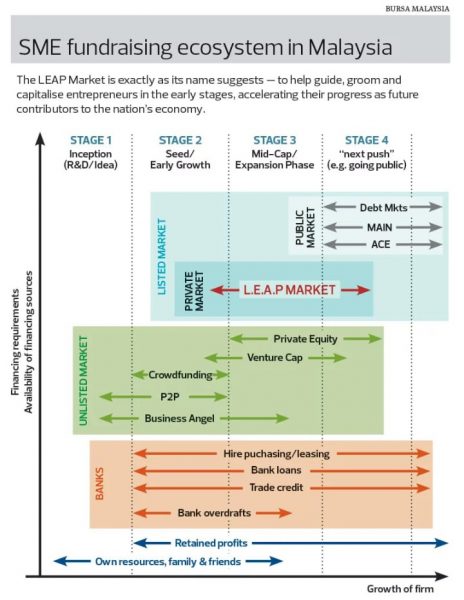

Amendments to Main Market Listing Requirements and ACE Market Listing Requirements. While the MAIN and ACE Markets are traded in the floor every day by anyone with the funds to buy and anyone intending to sell the LEAP Market operates differently. 1 Where any one of the percentage ratios of a transaction is 25 or more in addition to the requirements of Rule 1006 the listed corporation.

A Issues or offers an applicant. Full Text of the ACE LR GST Amendments. Key Changes to the Listing Requirement.

Requirements for transactions with percentage ratio of 25 or more. No minimum requirement on operating operating history size and history size and track-record track-record 3. PN Companies Cash Companies and Default in Payment.

Minimum requirements on 2. PART A GENERAL 1401 Introduction This Chapter sets out the requirements that must be complied with by a listed corporation its director and principal officers in relation to dealings by its directors and principal officers in listed securities. FAQ 147 PART B DEFINITIONS 1402 Definitions For the purpose of this Chapter unless the context otherwise.

Under the new regulatory regime Bursa is now a one-stop centre for all ACE Market IPO approvals including the registration of abridged prospectuses for the. Sub-Rules 1 and 2 do not apply to a transaction where the value of the consideration of the transaction is less than RM200000. The four are Wintoni Group Bhd Cybertowers Bhd RA Telecommunication Group Bhd and Scan Associates Bhd.

A total of 17 Main Market companies have slipped into Practice Note 17 PN17 status whereas only four ACE Market companies have fallen into Guidance Note 3 GN3 category. However the responsibility to review and register prospectuses of applicants and ACE Market listed corporations has to date remained under the SCs jurisdiction. As 1 January 2022 Chapter 4.

First there is the suitability for listing issue. Paragraph 32A of Practice Note 9 and Guidance Note 11 collectively the Guidance Notes released by Bursa Securities in respect of the Main and ACE Market Listing Requirements respectively further elaborates that in disclosing the application of each Practice in the Corporate Governance Report a listed corporation must provide a meaningful explanation. It adopts what is known as a Sophisticated Investor who meet certain requirements before the shares of the SME can be traded.

New Framework For Listings and Equity Fund-Raisings for ACE Market. De-list such GN3 Company subject to the latters right to appeal against the de-listing under sub-Rule 6 below. For the LEAP Market this is at 10.

Rule 1008 of the Listing Requirements stipulates the obligations that a listed corporation must comply with in relation to a related party transaction. If you intend to have your company listed in the ACE Market there are several factors that must be considered. Allow offer for sale for applicants with operating profit subject to moratorium 4.

Disallow offer for sale 3. Key Changes to the Listing Requirement. As the saying goes The rarer a thing is the more valuable it.

PN Companies Cash Companies and Default in Payment. EFFECTIVE Jan 1 Bursa Malaysia became the sole approving authority for IPOs on the ACE Market the second-largest listing platform of the stock exchange and home to 141 public listed companies PLCs. TABLE OF CONTENTS Page 1 ACE MARKET CHAPTER 1 DEFINITIONS AND INTERPRETATION PART A DEFINITIONS 101 Definitions PART B INTERPRETATION 102 Interpretation 103 Incidental powers etc of the Exchange 104 Gender 105 Singular and plural 106 Headings.

Pin On Virtual Assistant Services

Ace Market Enters A New Regulatory Regime The Edge Markets

Ace Of Hearts Svg Ace Of Hearts Silhouette Etsy Ace Of Hearts Illustration Design Illustration

Ace Market Enters A New Regulatory Regime The Edge Markets

Pin By Ooi Leong On Leong Coding Engineering Electrical Energy

Copacabana Palace Vintage Style Travel Decal Vinyl Sticker Luggage Label Ebay Vintage Labels Vintage Travel Posters Luggage Labels

New Ace Beaute Nostalgia Eye Palette In 2022 Eye Palette Sephora Fashion Tips

Ace Market Enters A New Regulatory Regime The Edge Markets

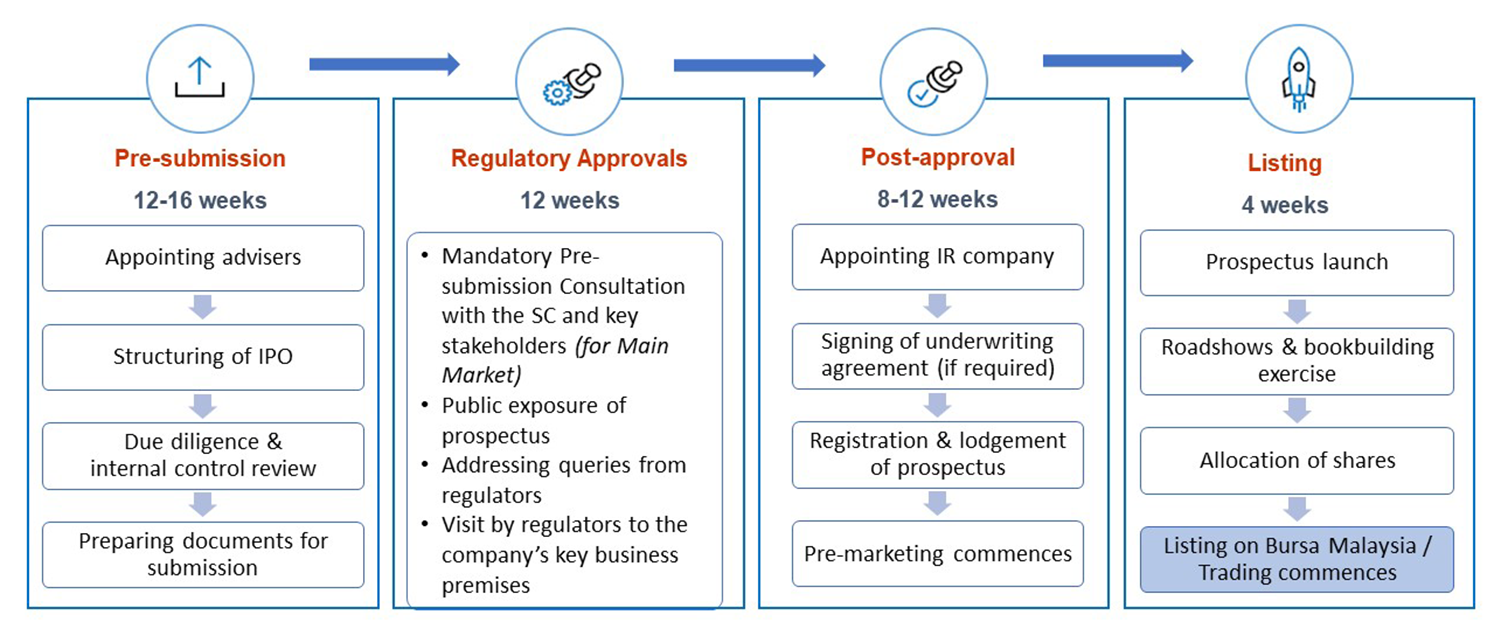

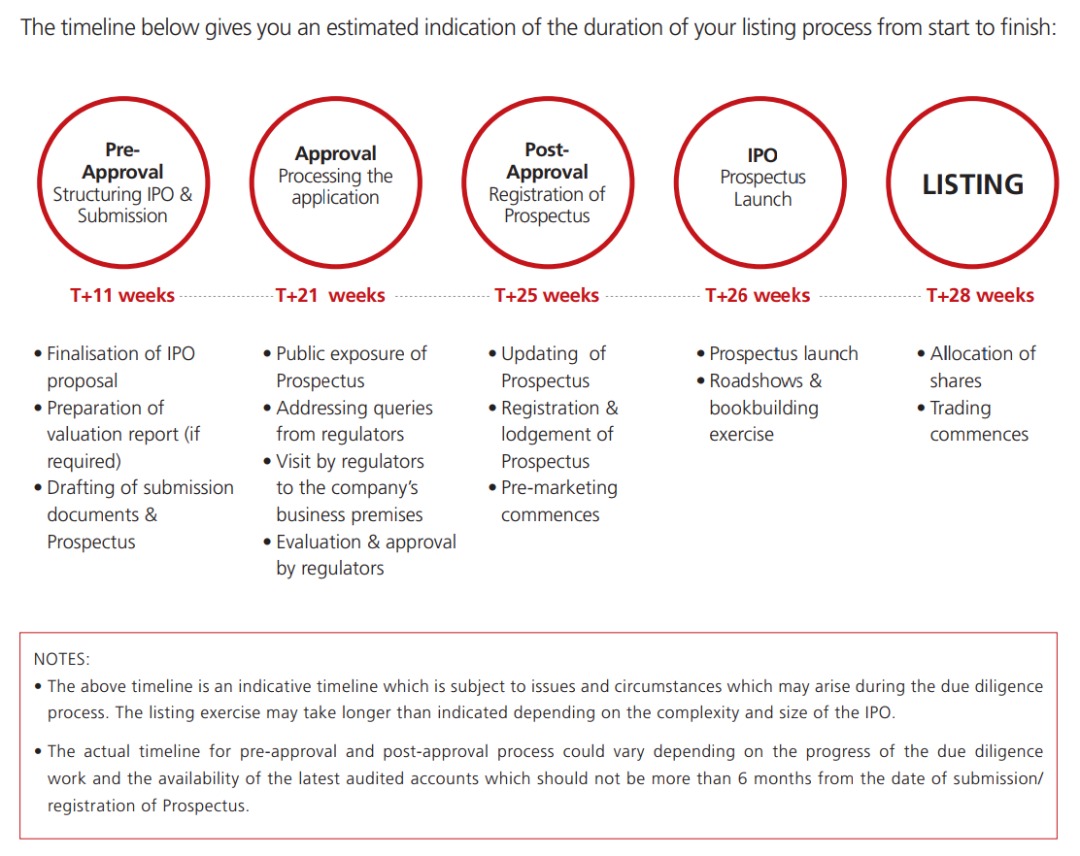

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Ace Market Enters A New Regulatory Regime The Edge Markets

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl